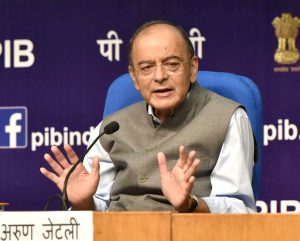

The Reserve Bank of India and the Union Government appear to be on a collision course if developments of recent days are any indication. So much so that the union Finance minister Arun Jaitley has accused the RBI of its failure to check indiscriminate lending by public sector banks during 2008 and 2014. The war of words between the government and the RBI took an unprecedented turn when the finance minister at an event organised by the US-India Strategic and Partnership Forum went on to comment that the Central Bank had been sleeping on the job. That shows the bitterness between the two.

The Reserve Bank of India and the Union Government appear to be on a collision course if developments of recent days are any indication. So much so that the union Finance minister Arun Jaitley has accused the RBI of its failure to check indiscriminate lending by public sector banks during 2008 and 2014. The war of words between the government and the RBI took an unprecedented turn when the finance minister at an event organised by the US-India Strategic and Partnership Forum went on to comment that the Central Bank had been sleeping on the job. That shows the bitterness between the two.

The finance minister said during his speech “The central bank looked the other way as the bank credit growth in one of these years was 31%, against the normal trend of 14%. I do not know what the central bank was doing. It was a regulator… They kept pushing truth below the carpet.”

The finance minister said during his speech “The central bank looked the other way as the bank credit growth in one of these years was 31%, against the normal trend of 14%. I do not know what the central bank was doing. It was a regulator… They kept pushing truth below the carpet.”

Dr. Viral V Acharya, Deputy Governor of RBI during his A.D. Shroff Lecture in Mumbai on October 26, 2018 “On the importance of regulatory institutions-the case of the Central Bank” quoting Alberto Ramos, Argentina analyst at Goldman Sachs said “Using central bank reserves to pay government obligations is not a positive development and the concept of excess reserves is certainly open to debate. It weakens the balance sheet of the central bank.”

He observed at the outset that “this complex interplay of the sovereign’s exercise of its powers, the central banker’s exit, and the market’s revolt, will be at the center of my remarks on why it is important for a well- functioning economy to have an independent central bank, a central bank that is independent from the executive branch of the government. I will also try to lay out why the risks of undermining the central bank’s independence are potentially catastrophic, a “self-goal” of sorts, as it can trigger a crisis of confidence in capital markets that are tapped by governments to run their finances”.

New kid on the block

Why independence of the central bank is important is because the inclusive economic and political institutions involve plurality in decision-making which help guarantee the rule of law and foster talent and creativity. Somewhat less celebrated is the institution of an independent central bank, perhaps not just because the central bank is a relatively new kid on the block because it interacts less directly with the public though its true influence is far- reaching.

A central bank performs several important functions for the economy: it controls the money supply; sets the rate of interest on borrowing and lending money; manages the external sector including the exchange rate; supervises and regulates the financial sector, notably banks; it often regulates credit and foreign exchange markets; and, seeks to ensure financial stability, domestic as well as on the external front.

The world over, the central bank is set up as an institution separate from the government; put another way, it is not a department of the executive function of the government; its powers are enshrined as being separate through relevant legislation. Its tasks being somewhat complex and technical, central banks are ideally headed and manned by technocrats or field experts – typically economists, academics, commercial bankers, and occasionally private sector representatives, appointed by the government but not elected to the office. This architecture reflects the acceptance of the thesis that central banks should be allowed to exercise their powers independently.

T20 vs Test Match

Why is the central bank separate from the government? A government’s horizon of decision-making is rendered short, like the duration of a T20 match, by several considerations. There are always upcoming elections of some sort — national, state, mid-term, etc. As elections approach, delivering on proclaimed manifestos of the past acquires urgency; where manifestos cannot be delivered upon, populist alternatives need to be arranged with immediacy.

In contrast, a central bank plays a Test match, trying to win each session but importantly also survive it so as to have a chance to win the next session, and so on. In particular, the central bank is not directly subject to political time pressures and the induced neglect of the future; by virtue of being nominated rather than elected, central bankers have horizons of decision- making that tend to be longer than that of governments, spanning election cycles or war periods. While they clearly have to factor in the immediate consequences of their policy decisions, central bankers can afford to take a pause, reflect, and ask the question as to what would be the long-term consequences of their, as well as government’s, policies. Indeed, by their mandate central banks are committed to stabilise the economy over business and financial cycles, and hence, have to peer into the medium to long term. Unsurprisingly, central banks strive to build credibility through a series of difficult choices that reflect sacrificing short-term gains for long-term outcomes such as price or financial stability.

Another explanation as to why the central bank is separate from the government relates to the observation that much of what the central bank manages or influences — money creation, credit creation, external sector management, and financial stability — involves potential front-loaded benefits to the economy but with the possibility of attendant “tail risk” in the form of back-loaded costs from financial excess or instability. For example, greater supply of money can facilitate ease of financial transactions, including the financing of government deficits, but this can cause economy to over-heat in due course and trigger (hyper-) inflationary pressures or even a full-blown crisis that eventually require sharper monetary contractions; excessive lowering of interest rates or relaxation in bank capital and liquidity requirements can lead to greater credit creation, asset-price inflation, and semblance of strong economic growth in the short term, but excessive credit growth is usually accompanied by lending down the quality curve which triggers mal-investment, asset- price crashes, and financial crises in the long term.

Sweeping bank loan losses under the rug by compromising supervisory and regulatory standards can create a façade of financial stability in the short run, but inevitably cause the fragile deck of cards to fall in a heap at some point in future, likely with a greater taxpayer bill and loss of potential output.

While not always the case, often the required interventions for stable growth are structural reforms by the government with upfront fiscal outlay; however, these may compromise populist expenditures or require displeasing incumbents. As a result, it might seem as an expedient solution to the government to ask/task/mandate/direct the central bank to pursue strategies that generate short-term gains but effectively create tail risks for the economy. To protect the economy from such short-termism, the central bank is designed to be at a safe distance from the executive branch of the government.

Influencing RBI working

Now, although the central bank is formally organised to be separate from the government, its effective horizon of decision-making can be reduced for short-term gains by the government, if it so desires, through a variety of mechanisms, like appointing government officials rather than technocrats to key central bank positions, such as Governor, and more generally, senior management. Another way is pursuing steady attrition and erosion of statutory powers of the central bank through piece-meal legislative amendments that directly or indirectly eat at separation of the central bank from the government.

The government can control its working by blocking or opposing rule-based central banking policies, and favoring instead discretionary or joint decision-making with direct government interventions; and by setting up parallel regulatory agencies with weaker statutory powers and/or encouraging development of unregulated entities that perform financial intermediation functions outside the purview of the central bank.

There are several reasons why enshrining and maintaining central bank independence ends up being an inclusive reform for the economy; and conversely, undermining such independence a regressive, extractive one.

When governance of the central bank is undermined, it is unlikely to attract or be able to retain the brightest minds that thrive on the ability to debate freely, think independently, and effect change; attrition of central bank powers results in attrition of its human capital and deterioration of its efficiency and expertise over time. When important parts of financial intermediation are kept outside the purview of the central bank, systemic risks can build up in “shadow banking” with private gains in good times to a small set of players but at substantive costs to future generations in the form of unchecked financial fragility.

Accountable to people

The central bank can of course make mistakes, and is generally held publicly accountable through parliamentary scrutiny and transparency norms. This way, the institutional arrangement of independence, transparency and accountability to the public not only balance but also strengthen the central bank’s autonomy. However, direct intervention and interference by the government in operational mandate of the central bank negate its functional autonomy.

Macroeconomic management can become a tug of war between securing stability and inflicting misdirection; daily operational decisions lead to power struggles; and, as the central bank is forced to bend over backwards to retain credibility in the face of imminent pressures that would erode its independence, counter efforts to reduce its independence escalate. As this dynamic plays out, markets watch keenly, and if uncertainty grows and confidence in central bank independence and credibility erode, then markets rap bond yields and exchange rate on the knuckles! The market can discipline the government not to erode central bank independence, and it can also make the government pay for its transgressions. Interestingly, the market also forces central banks to remain accountable and independent when it is under government pressure.

Independence of RBI

While the Reserve Bank has always derived several important powers from the Reserve Bank Act, 1935 and the Banking Regulation Act, 1949, what matters is the effective independence with which these powers can be exercised in practice. Over time, great strides have been undertaken by successive governments at the behest of the central bank, several economists, and umpteen committee reports, to restore the operational independence of the Reserve Bank. The Reserve Bank, like many central banks of the time, got quickly trapped into the socialist planning policies of post-independence government. Post the deregulation of interest rates in the 1990s, monetary policy achieved a more modern dimension.

To start with, there was a “multiple indicators” approach to setting interest rates. Importantly, this approach entertained much regulatory discretion. This made independence of monetary policy individual-specific; in other words, it allowed for government pressure to creep in easily for keeping rates low at times of fiscal expansion under one guise or the other.

Following several episodic bouts of double-digit inflation, a war on inflation and inflationary expectations, was finally launched in September 2013 by the then Governor Raghuram G Rajan; the Urjit Patel Committee Report to Revise and Strengthen the Monetary Policy Framework was released in 2014; and, finally, the Reserve Bank of India Act was modified in August 2016 to constitute the Monetary Policy Committee (MPC). The MPC consists of three RBI members, including the Governor who reserves a casting vote, and three external members appointed by the government. The MPC has been legislatively awarded a flexible inflation-targeting mandate of achieving 4% consumer price index (CPI) inflation in the medium term, while paying attention to growth, with operational independence to achieve it. The MPC, two years old since, has attempted steadfastly through its rate-setting decisions to build credibility of the inflation target, a process that is generally believed, and empirically documented, to help lower the long-term bond yields as well as stabilise the exchange rate. While the jury will remain out for some time on the economic impact of the flexible inflation-targeting framework, it is incontrovertible that the MPC has given monetary policy an independent institutional foundation.

For several decades post-independence, the Reserve Bank participated in short-term Treasury Bill issuances of the Government of India (bearing extraordinarily low interest rates) to fund its fiscal deficits. The Reserve Bank also publicly acknowledged that its open market operations (OMOs) were primarily geared to manage the government bond yields. This implied that the central bank balance-sheet was always available as a resource — just like tax receipts — ready to monetise excessive government spending.

Challenges before RBI

The independence of the Reserve Bank can still be maintained by regulation of the public sector banks. One important limitation is that the Reserve Bank is statutorily limited in undertaking the full scope of actions against public sector banks (PSBs) — such as asset divestiture, replacement of management and Board, license revocation, and resolution actions such as mergers or sales — all of which it can and does deploy effectively in case of private banks.

Having adequate reserves to bear any losses that arise from central bank operations and having appropriate rules to allocate profits (including rules that govern the accumulation of capital and reserves) is considered an important part of central bank’s independence from the government. A final issue is one of regulatory scope, the most recent case in point being the recommendation to bypass the central bank’s powers over payment and settlement systems by appointing a separate payments regulator. The RBI has published its note of dissent against this recommendation on October 19, 2018. The deputy governor of the RBI gave a parting shot. “As many parts of the world today await greater government respect for central bank independence. The Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution,” he said.

letters@tehelka.com