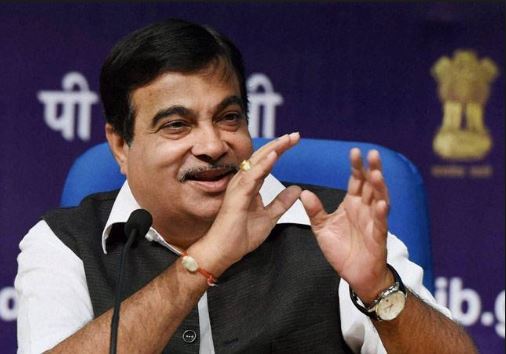

Union Minister Nitin Gadkari on Thursday said that non payment and delay in payments to MSME enterprises will be dealt with very firmly. The Minister reiterated the Government’s commitment to solve long standing problems of the MSME sector and give it the required support so that it can realize its full potential in terms of its contribution to GDP and employment generation.

The Minister was speaking at a national workshop organized by the MSME Ministry to discuss the issue of delayed payments to MSMEs and ways to deal with it. He said that the Finance Ministry has recently taken some initiatives for the sector which will go a long way in strengthening it. Gadkari further assured that the recommendations of the UK Sinha committee will be implemented soon.

Besides Ministry officials and bankers, the workshop is being attended by entrepreneurs and various stakeholders from the MSME sector. Presentations were made by TReDS, Bombay Stock Exchange, Chamber of Indian MS&M Enterprises, NeSL (National e-governance Services Limited) on the initiatives that are being taken to tackle the problem of delayed payments. Many stakeholders suffering from delayed payments, spoke about their complaints and placed suggestions before the Minister and senior officials.

Gadkari appealed all the stakeholders to use MSME Samadhan Portal so that sufficient data could be gathered about wilful defaulters, register themselves on stock exchanges and also assured them that the ministry will soon launch a marketing portal ‘Bharat Craft’ for the marketing of their products.

Secretary MSME Arun Kumar Panda assured stakeholders that all their suggestions and problems will be looked into by the Ministry.

Nitin Gadkari also Re-Launched the Credit Linked Capital Subsidy (CLCS) web portal on the occasion. CLCS is a scheme that provides 15% subsidy for additional investment up to ₹ 1 cr. for technology upgradation by MSEs. In the relaunched scheme there is an additional 10 percent subsidy to SC-ST entrepreneurs. MoUs were also signed by the office of DC, MSME with 11 Nodal Banks.