Holidays let you break the life’s monotony by allowing you to rejuvenate all your senses. The fun and pleasure reach a new height when it is a family trip with your loved ones. While a holiday can help you create some priceless memories with your dear ones, you need to pay ‘price’ to create and enjoy those moments.

In an ideal situation, everyone should have enough money to travel; however, in reality, it doesn’t happen. While it is strongly advised to plan and save money for your leisure holiday, many times a little extra cash can help you elevate your experience and make it an everlasting memory. Here, a personal loan is the best way-out option for you. Go with a personal loan to fund your vacation and meet any shortfall.

What is a Personal Loan?

A personal loan is one of the smooth forms of finance available to fund a holiday, considering the fact that you can get online approval on your personal loan application in 30 minutes without collateral or security. The loan helps to meet all the expenditure related to your holiday, such as fares, tour packages, travel gears, sightseeing, Visa fees, etc. Like other loan options, the lender would assess your income, credit score, employment/business details while deciding the amount.

The best thing about a personal loan is that you can use the loan amount to fund needs other than those associated with your holiday as well. It means you can use personal loan not only for buying travel tickets and making hotel reservations but also for purchasing new clothes for a holiday. Further, the remaining amount can be used to buy new home appliances, repay credit card dues, and for many such things.

What Makes Personal Loan an Attractive Option for Travellers?

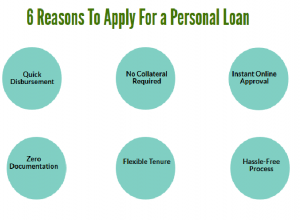

Here are some features of personal loan which makes it an apt choice to fund your next family trip:

- As the loan disbursement process is fast, you can travel without delay

- You can choose flexible repayment tenures, as per your convenience

- In most of the cases, personal loans are unsecured loans which mean; you don’t need to pledge collateral or security to get the loan, this also means easier documentation

- A personal loan helps you spread the holiday expenses over a stipulated time frame which aids in repayment

- As you can get a personal loan up to Rs 15 lakhs based on your credit eligibility, it is easy to plan a foreign vacation with your family

Be Vigilant

While personal loans help you in case of a planned holiday or an impromptu trip, here are some points which need to be considered while opting for the loan:

- Evaluate your borrowing needs. Before borrowing, ask yourself, “Can I repay it?” Borrow only what you can repay. There should be a clear distinction between the itinerary cost (e., food, lodging, transport, etc.) and the loan amount

- When you have decided to take a personal loan to fund your travel expenses, start shopping to find the right option to cover your expenses. Both banks and non-banking financial institutions offer personal loans, and therefore, instead of treading on a traditional path and approaching banks only, it is wise to compare and analyse the available options carefully

- Make sure you have a regular source of income to repay the loan. It is essential to save the money first and use it later to repay your loan

- One should go with the lender who transfers your money directly to the notified account in a short span of time. Some lenders offer an online decision mechanism wherein the customer gets approval in a few minutes and disbursement is also quick

- It is essential to check your credit score before applying to know where you stand. A high credit score can help you avail the loan in easy terms, so make sure you have a good score. If your credit score is low, take the time to build it before applying for the loan

- Keep your repayment tenure based on your current capability to repay EMI on a monthly basis.

Whether it is planned or unplanned, a holiday comes with a hefty price tag. Therefore, make sure that you have enough funds before you take a trip. However, in case your vacation expenses exceed your current fund, resort to personal loan.

As memories made ‘together’ last a lifetime, it is time to plan that ever-pending trip to the dream destination with your family. While, you decide when and where to travel, leave all your money woes to personal loan.

ADVT