Page 10 - 15OCT2018E

P. 10

BANKING

Any restructuring

in banking entities

with majority stake

United; the banks may stand, to the outfits of promoters’ choice. This of government has Finally, the end use of the loan should

ramifications not only

over confidence pushed the banks into

be examined thoroughly. The loan

survive and overcome losses the quagmire of sour assets. for those who are should be raised for the productive pur-

pose, to enhance the income level of the

Government has a majority stake

directly concerned,

in 21 private sector banks and this

borrower,” said Samara.

accounts for two-third of the assets of

There is enough evidence that the

banking industry. The total NPAs of the but also on the entire undue political and bureaucratic inter-

banking sector stands at 10 lakh crore eco-system ference in decision making at different

The proposal to merge three public sector banks — Bank of Baroda, Vijaya Bank and Dena Bank — as on the end of financial year 2017-18, levels has been responsible to the pre-

is a step further towards the consolidation of banking sector in the country, writes KOMAL AMIT GERA with public sector banks contributing sent state of affairs in banking sector in

a colossal 90% of the total NPAs that banks falling under the ambit of PCA India. This can be corroborated by the

amounts to 8.9 lakh crore. Out of these framework. note submitted by the former Governor

he recent announced pro- banks command a dominant share and performing assets. 21 banks, 11 are currently under the PCA Giving a banker’s perspective on of Reserve Bank of India, Raghuram Ra-

posal to merge three pub- presence in the Indian economy and Among the three entities proposed (Prompt Corrective Action of Reserve mergers, Saravjit Singh Samra, Manag- jan to Chairman of Estimates Commit-

lic sector banks — Bank of any restructuring in banking entities to be merged; Bank of Baroda and Bank of India); thus have restrictions ing Director of Capital Local Area Bank, tee, Murli Manohar Joshi. He blamed

Baroda, Vijaya Bank and with majority stake of government has Vijaya Bank have healthy balance on lending, distribution of dividends said that the amalgamation of banks the slow decision making at the Centre

T Dena Bank — is a step fur- ramifications not only on those who are sheets with gross NPAS of 12.46 per and profits (if they have any) and provi- may have some challenges in short- during the regimes of UPA and the pre-

ther towards the consolidation of directly concerned, but also on the en- cent and 6.19 per cent and net NPAs sioning of sour loans. run, but it would give a vigour to the sent NDA Government for magnifying

banking sector in India. While the tire eco-system. of 5.4 per cent and 4.1 per cent respec- The Finance Minister Arun Jaitley, banking industry in the long-run. He the malady of bad loans. In the note,

announcement was made on Septem- While the consolidation of banks in tively. The third institution, Dena Bank during Annual Performance Review added that India is a vast country with Rajan has reportedly suggested need

ber 17 by the Union Finance Minister India was suggested by Narasimham reportedly has 22.69 per cent gross and Meeting of Public Sector Banks on Sep- diverse needs; the large banks have dif- of improving governance of PSBs and

Arun Jaitly, the regulatory processes are Committee on banking reforms way 11 per cent net NPAs, evidently seeking a tember 25 sought the feedback of the ferent focus area to match the growing stricter norms for project evaluation

expected to be completed by the end of back in 1990s, the recommended de- bailout to save itself from collapse. bankers on various issues to improve needs of the economy. The Capital Local and monitoring the lending process.

financial year 2018-19. gree of consolidation remained tardy A big question about the outcome the performance ailing banking sec- Area Bank, the first Small Finance Bank Though rules are in place, but un-

The proposal had been evolved by due to lack of government impetus. It of the amalgamation of banks has tor. The bankers, during the meeting, of India launched in April 2016 posted fortunately all the rules and guidelines

the Alternative Mechanism, compris- had recommended three-tier banking also been raised by those who dissent solicited relaxation in PCA framework Gross NPA of 1.17 per cent and Net NPA designed to curb the NPAs in letter and

ing Union Ministers Arun Jaitley, Nir- structure in India through carving out this move. The gross NPAs of State to resolve the snags in lending activity. of 0.85 per cent of the total advances as spirit for small ticket borrowers who

mala Sitharaman and Piyush Goyal three large banks with global footprint, Bank of India have shot up post merger The PCA guidelines, according to bank- on June 30, 2018. mortgage their assets of value more

— when formalised — it would pro - eight to ten banks having pan-India op- from 1.12,343 on 31st December 2016 to ers, were creating obstacles to achieve “Three basic tools, if used prudently, than the amount borrowed. The big

duce the third largest lender in India. erations and large number of regional 1.99,441 on 31st December 2017 to the conformity with the Basel III (an can save a bank from falling into trap ticket borrowers come with a recom-

The approval framework for mergers and local banks. The committee also 2,23,427 cr on 31st March 2018 as per internationally agreed set of measures of bad loans and these are equally ap- mendation from the power wielders

of SBI and five associate banks along advocated the Non-Performing Assets an RTI reply by SBI. on bank capital adequacy, stress testing plicable to large and small banks. To of the system and the funds meant are

with Bhartiya Mahila Bank (that came to be brought down to 3% by the year The major culprit in the rise of toxic and market liquidity risk), that has to be assess the intentions of the borrower appropriated by the recalcitrant

into effect from April 1,2017) ; takeover 2002. loans was the stalled power and infra- fully implemented by March 2019. It has is the most essential parameter on borrowers. The former RBI had also

of IDBI by Life Insurance Corporation The banking sector in India has structure projects that culminated into been reported that PSBs have request- which lending has to be decided. The informed the Parliament that a list of

of India and amalgamation of Bank of been navigating through turbulent delayed repayments and non-service ed the Finanace Minister for relaxa- repayment capacity should be evalu- high-profile defaulters was sent to the

Baroda, Vijaya Bank and Dena Bank time. The negative spillovers from the of debts. High business activity from tion net Non-Performing Asset criteria ated; here the need to probe the past Prime Minister Office to take action but

were prepared by the Alternative global markets, less than adequate year 2000 to 2006 resulted in over and Minimum Capital Requirement of track record of the borrower is crucial. of no consequence. The RBI’s Financial

Mechanism. demand for credit in the domestic projection and banks accepting higher Stability Report had earlier this year

All the three attempts have been market, sluggish exports, stress in steel, leverage in projects and less promoter said that larger borrower accounted for

made to integrate loss making entities power and infrastructure sector and equity. The sentiments were so high 54.8 per cent of the gross advances and

with the healthy players to create op- subdued confidence of investors have that sometimes banks even outsourced 85.6 per cent of gross NPAs.

erational synergies. The public sector largely contributed towards rising non- the due diligence and project analysis The schemes announced in favour

of small industries and agriculture like

MUDRA loans and Kisan Credit Cards

need scrutiny as Rajan had cautioned

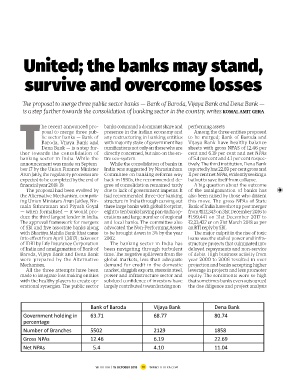

Bank of Baroda Vijaya Bank Dena Bank for the next phase of banking crisis

Government holding in 63.71 68.77 80.74 from these segments. But it needs a

deeper analysis as the per capita loan in

percentage this category is minimal as compared to

Number of Branches 5502 2129 1858 the big defaulters and the credit leakag-

es at different levels undermine the re-

Gross NPAs 12.46 6.19 22.69 paying capacity of the small borrowers.

Net NPAs 5.4 4.10 11.04

LETTERS@TEHELKA.COM

WTEHELKA / 15 OCTOBER 2018 10 WWW.TEHELKA.COM

10-11 Komal Amit Gera.indd 2 9/28/2018 4:45:30 PM 10-11 Komal Amit Gera.indd 3 10/1/2018 12:14:54 PM