The United Kingdom has been hogging headlines in the international and Indian media on different counts from time to time and in recent days London stole the limelight in the wake of general elections and the resounding victory of the Conservatives led by Boris Johnson and in the coming weeks, especially during the closing part of January 2020, the British moves on the Brexit are prone to hog media headlines as well.

The United Kingdom has been hogging headlines in the international and Indian media on different counts from time to time and in recent days London stole the limelight in the wake of general elections and the resounding victory of the Conservatives led by Boris Johnson and in the coming weeks, especially during the closing part of January 2020, the British moves on the Brexit are prone to hog media headlines as well.

Nevertheless, London has also remained in focus of the media for being the tax haven for overseas billionaires who have been parking their money in the UK by investing in property, hotel business and other activities. The strange cases of Vijay Malaya and Nirav Modi, who fled India last year and are alleged to have duped India’s banks of money amounting to thousands of crores of rupees and have been facing extradition proceedings in London courts, is just tip of the iceberg of the role of foreign money in the British economy.

The British economy

The British economy, a highly developed and market-oriented economy, ranks as the sixth largest economy in the world gauged by normal GDP, ninth largest measured by purchase power parity (PPP), and 22nd largest by GDP per capita, accounting for 3.3 per cent of global GDP. Exports, service sector, and industry constitute the main drivers of its economy. The UK comprising England, Scotland, Wales, and Northern Ireland, is one of the globalized economies, which is the tenth largest goods exporter and the fifth largest goods importer in the world.

According to broad estimates, service sector contributes nearly 80 per cent of the GDP and financial services industry has catapulted London at the enviable position to be the second largest global financial hub. With aerospace and pharmaceutical industries playing pivotal role in the British economy, the UK also enjoys the unique status of being home to be the headquarters of 26 of the world’s 500 largest companies.

Reports appearing in the British media from time, citing the figures of National Crime Agency (NCA), suggest that many hundreds of billions of dollars of international money is rinsed through British banks annually. Many of the cross-border corruption cases taking place in recent years are said either to have connection to Britain or its overseas territories. British limited-liability partnerships are often used as instrument to channelize suspicious money transactions that sometimes amount to hundreds of billions of dollars. Undoubtedly, in the aftermath of the 2008 global financial crisis bail-out and austerity measures had affected British economy that led to leniency in tackling dirty capital flows; nevertheless, concurrently a section in the political and economic circles still argues that stringent clean-up measures could harm not only the British finance but may also make the UK losing its lustre because of Brexit.

Some financial experts in the British capital, while referring to international financial hubs like New York, Dubai and Singapore where dodgy cash is cleaned up, assert that London entails unique traits in handing vast amounts of dirty money. One expert has opined that tycoons facing arbitrary rules at home can seek refuge under British legal system where relaxed rules on ownership are geared towards rich foreigners. Apart from London, British offshore territories also serve as ideal places for money laundering.

In the aftermath of promulgation of the Criminal Finances Act 2017, sweeping powers have been vested in the British government to investigate those involved. Besides, Unexplained Wealth Orders (UEOs), introduced in February 2018, require recipients explain property purchases which far exceed their reported income. All these are touted as positive measures to undo the impacts of black money. It is often argued that many foreigners set up their shop in London to escape corruption allegations back home and they park their illicit money in purchasing luxurious properties.

According to some analysts, targeting individuals and/or their funds becomes riskier as the UK government lacks jurisdiction to prosecute as well as the extrajudicial investigative capabilities. In this regard, one analyst has observed that Britain’s response to the threat posed by illicit financial flows has so far been more thundering rhetoric than meaningful action.

Indian Diaspora

Indian Diaspora in the UK, comprising about 1.4 million people, excluding those of mixed Indian and other ancestry, is the single largest visible ethnic minority and the largest subgroup of British Asians. Most of the British Indians are said to belong to middle to upper middle class, with bulk of them engaged in professional and managerial vocations.

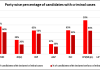

Presence of Indian Diaspora in Britain has come to wield substantial influence on British culture — from food and the arts to entertainment and politics. In the outgoing House of Commons, there were 12 British Indian MPS and in the recently held general election, the number of British Indian MPs has gone up to 15 in the new House. Besides, in the aftermath of dismal performance of the Labour Party in recent election, a British Indian MP is being tipped to head the Labour Party.

Interestingly, India is fast losing its high net worth individuals (HNI), also termed as dollar-millionaires to migration in recent years. Approximately 23, 000 dollar-millionaires left India since 2014, with 7, 000 leaving in 2017 and 5000 leaving in 2018; and the crackdown on black money set in motion by the NDA government headed Prime Minister Modi is said to be the most plausible cause for the exodus. India along with China and Russia are the top three countries having witnessed the exodus of HNIs in recent years to Australia, Canada, Dubai, UK and other destinations.

According to broad estimates based on media reports, gross illicit assets worth US $ 462 billion had been parked abroad by some of the Indians migrating abroad and presently that number might have grown further. London is said to be a favourite jaunt for the migrating wealthy Indians and many of them own hotels, restaurants, and entertainment outlets in the British capital. Many luxurious dwelling units are owned by the British Indians. According to one expert, offshore component of many Indian business deals has made London an attractive spot. Vijay Malaya, the arms dealer Sanjay Bhandari, Sudhir Choudhrie, Ravi Shankaran and Abhishek Varma have all found safety and comfort in London and they own sizeable property there. There. A good deal of arms dealing was facilitated by the Nanda family via London. Recycling of capital flows to India via Cyprus, Mauritius or Jersey is connected through the UK.

Vijay Vittal Mallya, an Indian business tycoon, currently facing extradition proceedings in London, is the subject of an extradition effort by government of India to be brought to India from the UK to face charges of alleged unpaid debt of around 1.145 billion pounds. The property owned by him in the UK, inter alia, includes: two superyachts, a game reserve in South Africa, numerous undeclared high-value and vintage cars, valuable paintings and a piano previously owned by famous British singer-songwriter Elton John etc. He is also said to own a plush home overlooking Regent’s Park in the heart of London.

Vijay Vittal Mallya, an Indian business tycoon, currently facing extradition proceedings in London, is the subject of an extradition effort by government of India to be brought to India from the UK to face charges of alleged unpaid debt of around 1.145 billion pounds. The property owned by him in the UK, inter alia, includes: two superyachts, a game reserve in South Africa, numerous undeclared high-value and vintage cars, valuable paintings and a piano previously owned by famous British singer-songwriter Elton John etc. He is also said to own a plush home overlooking Regent’s Park in the heart of London.

Fugitive diamond merchant Nirav Modi, wanted in India in connection with duping Indian banks to the tune of nearly US $ 2 billion, has been lodged at Wandsworth prison in south-west London, one of England’s most overcrowded jails, since his arrest in March 2019 on an extradition warrant. Currently under judicial custody, he will face his extradition trial hearing in May 2020. He is said to live in a property worth over 8 million pounds (over Rs 72 crore) near Oxford Street in London’s West End, Nirav Modi has been given the Nation Insurance Number, which allows him to do business in the UK.

Fugitive diamond merchant Nirav Modi, wanted in India in connection with duping Indian banks to the tune of nearly US $ 2 billion, has been lodged at Wandsworth prison in south-west London, one of England’s most overcrowded jails, since his arrest in March 2019 on an extradition warrant. Currently under judicial custody, he will face his extradition trial hearing in May 2020. He is said to live in a property worth over 8 million pounds (over Rs 72 crore) near Oxford Street in London’s West End, Nirav Modi has been given the Nation Insurance Number, which allows him to do business in the UK.

The author is Executive Editor of News24. Views expressed are the author’s own

letters@tehelka.com