The Reserve Bank of India (RBI) on Friday left the key lending rate unchanged for a third time in a row as inflation stayed stubbornly high.

The Reserve Bank of India (RBI) on Friday left the key lending rate unchanged for a third time in a row as inflation stayed stubbornly high.

The repo rate remains unchanged at 4% while the reverse repo rate or the key borrowing rate stayed at 3.35%.

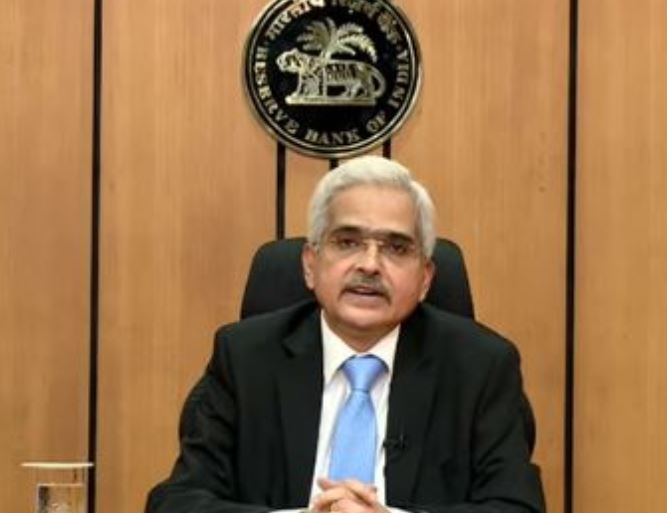

RBI governor Shaktikanta Das said that the Monetary Policy Committee (MPC) met on 2nd, 3rd and 4th December 2020. It reviewed current macroeconomic and financial developments, both domestic and global, and the evolving outlook for the Indian economy. At the end of its deliberations, the MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent.

“It also decided to continue with the accommodative stance of monetary policy as long as necessary – at least through the current financial year and into the next year – to revive growth on a durable basis and mitigate the impact of COVID-19, while ensuring that inflation remains within the target going forward. The Marginal Standing Facility (MSF) rate and the Bank rate remain unchanged at 4.25 per cent. The reverse repo rate stands unchanged at 3.35 per cent,” he said.

CPI inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October 2020, with some evidence that price pressures are spreading. The outlook for inflation has turned adverse relative to expectations in the last two months. CPI inflation is projected at 6.8 per cent for Q3:2020-21, 5.8 per cent for Q4:2020-21; and 5.2 to 4.6 per cent in H1:2021-22, with risks broadly balanced, according to the statement.

The recovery in rural demand is expected to strengthen further, while urban demand is also gaining monentum. Consumers remain optimistic about the outlook and business sentiment of manufacturing firms is gradually improving. Fiscal stimulus is increasingly moving beyond being supportive of consumption and liquidity to supporting growth-generating investment. On the other hand, private investment is still slack and capacity utilisation has not fully recovered. While exports are on an uneven recovery, the prospects have brighteneed with the progress on the vaccines. Taking these factors into consideration, real GDP growth is projected at (-) 7.5 per cent in 2020-21: (+) 0.1 per cent in Q3:2020-21 and (+) 0.7 per cent in Q4:2020-21; and 21.9 per cent to 6.5 per cent in H1:2021-22, with risks broadly balanced, the RBI Governor said.