Reserve Bank of India (RBI) on Friday announced fresh measures to provide impetus towards reviving the economy amid COVID-19.

Reserve Bank of India (RBI) on Friday announced fresh measures to provide impetus towards reviving the economy amid COVID-19.

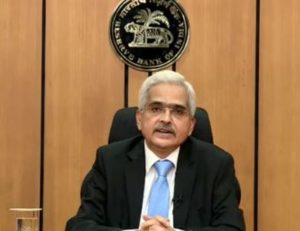

The measures announced by RBI Governor Shaktikanta Das are intended to enhance liquidity support for financial markets, regulatory support to improve the flow of credit to specific sectors within the ambit of the norms for credit discipline, provide a boost to exports and deepen financial inclusion and facilitate ease of doing business by upgrading payment system services.

The focus of liquidity measures by the RBI will now include the revival of activity in specific sectors that have both backward and forward linkages and multiplier effects on growth. Accordingly, RBI has decided to conduct on tap TLTRO with tenors of up to three years for a total amount of up to ₹1,00,000 crore at a floating rate linked to the policy repo rate. The scheme will be available up to March 31, 2021, with flexibility with regard to enhancement of the amount and period after a review of the response to the scheme. Liquidity availed by banks under the scheme has to be deployed in corporate bonds, commercial papers, and non-convertible debentures issued by entities in specific sectors over and above the outstanding level of their investments in such instruments as on September 30, 2020. The liquidity availed under the scheme can also be used to extend bank loans to these sectors. Moreover, banks that had availed of funds earlier under targeted long-term repo operations (TLTRO and TLTRO 2.0) will be given the option of reversing these transactions before maturity. In view of the borrowing requirements of the centre and states in the second half of 2020-21 and the likely pick-up in demand for credit as the recovery gathers strength, on tap TLTROs are intended to enable banks to conduct their operations smoothly and seamlessly without being hindered by illiquidity frictions. The objective is to ensure that liquidity in the system remains comfortable.

On September 1, 2020, the RBI increased the investments permitted to be classified as Held to Maturity (HTM) from 19.5 per cent to 22 per cent of NDTL in respect of SLR securities acquired on or after September 1, 2020, up to March 31, 2021. In order to provide certainty to banks as regards their investments and to foster orderly market conditions while ensuring congenial financing costs, RBI decided to extend the dispensation of the enhanced HTM limit of 22 percent up to March 31, 2022, for securities acquired between September 1, 2020, and March 31, 2021. It is expected that banks will be able to plan their investments in SLR securities in an optimal manner.

In order to impart liquidity to State Development Loans (SDLs) and thereby facilitate efficient pricing, RBI decided to conduct open market operations (OMOs) in SDLs as a special case during the current financial year. This would improve secondary market activity and rationalize spreads of SDLs over central government securities of comparable maturities. This measure, along with the extension of HTM till March 2022, should ease concerns about illiquidity and absorptive capacity for the total government borrowing in the current year.

Exports have been adversely impacted by the pandemic-related contraction in external demand. In this environment, it is crucial to provide flexibility to exporters in the realisation of export proceeds and to empower them to negotiate better terms with overseas buyers. In order to facilitate the same, and make the caution-listing process exporter-friendly and equitable, RBI decided to discontinue the system-based automatic caution-listing. The RBI will henceforth undertake caution-listing on the basis of case-specific recommendations of the Authorised Dealer (AD) banks.

At the current juncture, the financial sector has a crucial role in leading the nascent economic revival. It is in this context that the RBI is announcing certain measures aimed at catalysing augmented credit flows to the productive sectors of the economy.

Under the extant framework, the maximum aggregated retail exposure to one counterparty should not exceed the absolute threshold limit of ₹5 crore. In order to facilitate higher credit flow to this segment, which mainly consists of individuals and small businesses (i.e. with turnover of upto ₹50 crore), and in harmonization with the Basel guidelines, RBI decided to increase this threshold to ₹7.5 crore in respect of all fresh as well as incremental qualifying exposures. This measure is expected to expand credit flow to small businesses.

Under the extant regulations, differential risk weights are applicable to individual housing loans, based on the size of the loan as well as the loan-to-value ratio (LTV). In recognition of the role of the real estate sector in generating employment and economic activity, RBI decided to rationalise the risk weights and link them to LTV ratios only for all new housing loans sanctioned up to March 31, 2022. This measure is expected to give a fillip to the real estate sector.

In 2018, the RBI put in place a framework for co-origination of loans by banks and a category of Non-Banking Financial Companies (NBFCs) for lending to the priority sector, subject to certain conditions. Based on the feedback received from stakeholders, RBI decided to extend the scheme to all NBFCs, including HFCs, in respect of all eligible priority sector loans, and allow greater operational flexibility to the lending institutions. This “Co-Lending Model” is expected to leverage the comparative advantages of banks and NBFCs in a collaborative effort, and improve the flow of credit to the unserved and underserved sectors of the economy.

In December 2019, the RBI made available the National Electronic Funds Transfer (NEFT) system on a 24x7x365 basis and the system has been operating smoothly since then. In order to facilitate swift and seamless payments in real-time for domestic businesses and institutions, RBI decided to make available the RTGS system round the clock on all days from December 2020. India will be among very few countries globally with a 24x7x365 large value real-time payment system. This will facilitate innovations in the large value payments ecosystem and promote ease of doing business.

Under the Payment and Settlement Systems Act, 2007 the RBI currently gives on tap authorisation to payment system operators (PSOs) for limited periods of up to five years. In order to obviate licensing and business uncertainty for PSOs, it has been decided to grant authorisation for all PSOs (new applicants as well as existing PSOs) on a perpetual basis, subject to certain conditions. This will reduce compliance costs and create a climate conducive for investment activities, increased employment, and infusion of new talent and technologies into value chains.