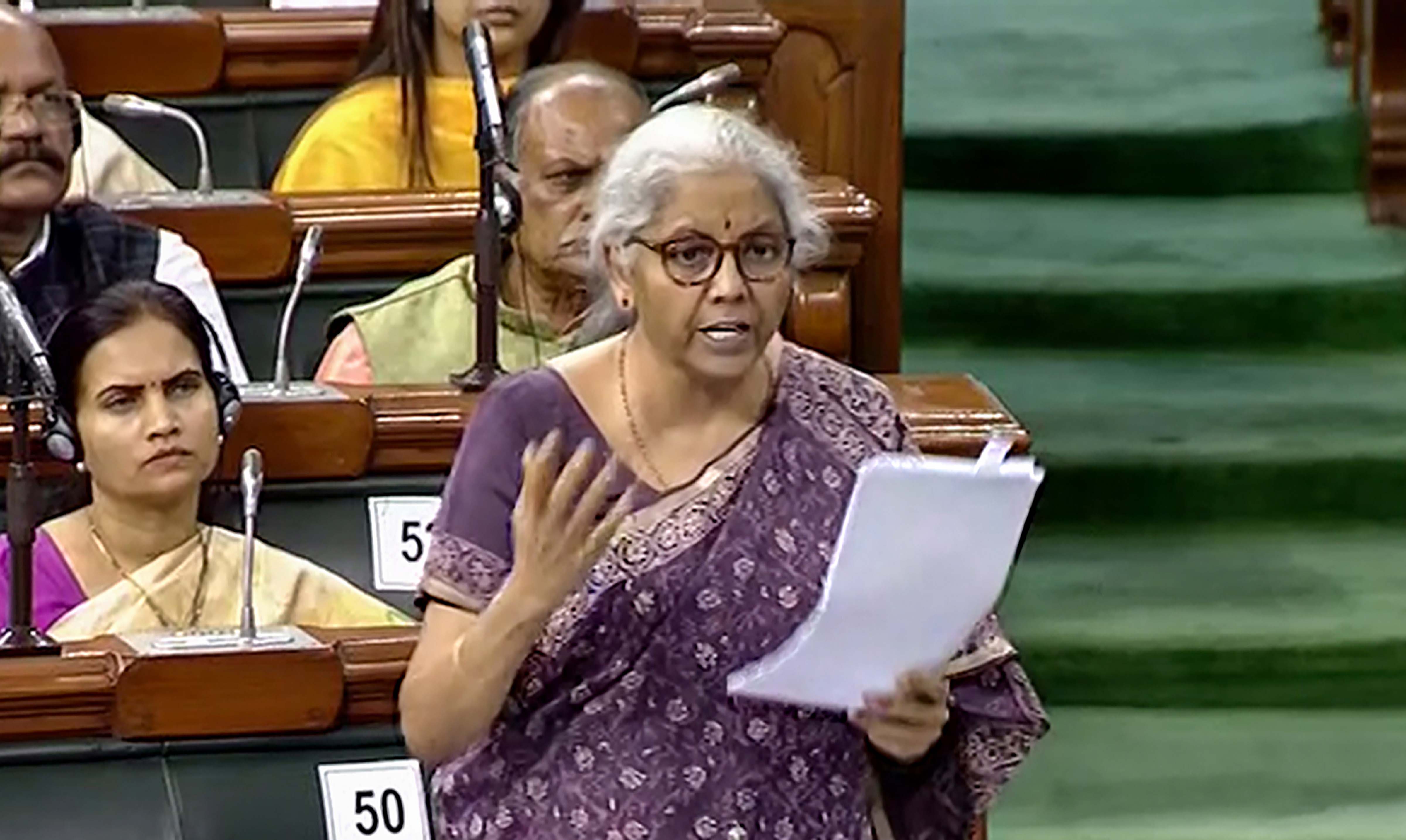

Union finance minister Nirmala Sitharaman said in the Lok Sabha that the RBI is in favour of banning cryptocurrencies. While there are genuine concerns over the usage of virtual currencies, regulating them rather than imposing a ban could be a viable option, writes Narvir Rooprai

Money has three main attributes: it is used as a unit of account, as a medium of exchange, and as a store of value. In most countries, money is issued by a government backed authority (such as RBI in India) and carries sovereign guarantee. Entities authorised to hold money and enable payments (such as banks, credit cards and payment wallets) are licensed by a government agency. This means that there is a government-regulated centralised system of validating transactions and keeping track of money flow.

The Union Finance Minister said, “In view of the concerns expressed by RBI on the destabilising effect of cryptocurrencies on the monetary and fiscal stability of a country, RBI has recommended framing of legislation on this sector. RBI is of the view that cryptocurrencies should be prohibited.”

As at present, cryptocurrencies are not regulated in India. The Finance Minister had announced the launch of India’s own digital currency by the RBI next year 2023 that will be based on Blockchain technology. With this, India will join certain countries that have their own central bank digital currency (CBDC) that refers to the virtual form of a fiat currency. “Digital rupee to be issued using Blockchain and other technologies by the RBI starting 2022-23,” said Sitharaman in Parliament.

However, the much-expected Cryptocurrency Bill is yet to see the light of the day. One reason is that effective legislation on this matter is possible only through international collaboration. Cryptocurrencies are by definition borderless and require international collaboration to prevent regulatory arbitrage. Therefore, any legislation for regulation or for banning can be effective only after significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards.

What is Cryptocurrency

Historically, currencies were devised as means to replace the barter system. Currencies that we use in our regular life are also known as “fiat currencies” since they are backed by a convertible or a commodity. In simple terms, the currency that we use is issued by the Government and is a promissory note issued by the Government promising to pay the bearer the amount specified on the currency.

The Virtual Currencies are basically a collection of binary data, which is stored using cryptography to secure the transaction records. VCs are not fiat currencies and are not backed by the Government. VCs are based on the concept of decentralised control and have no single authority regulating its issuance. VCs do not exist physically. They are distributed over a vast network of computers. Unlike regular currencies, VCs have a limit. Every ASCII computer file specifies the quantity of a coin. Thus, as the demand for VCs increase, so does its value. It works on the principle of demand and supply.

VCs also have the advantage of eliminating third party merchants such as Visa or Master Card and therefore an end user does not have to pay commission, bringing down the transaction cost. They are also irreversible. So, if a transaction is carried out, it cannot be reversed. The VCs are stored in a digital wallet, which can only be accessed by a private key. It is like an unbreakable vault, which can only be opened with the set of keys provided. If you lose the key, you lose the contents in the vault. There is a popular saying in crypto : “not your keys, not your coins”, meaning that if you don’t hold your own private keys, you can’t really be in control of your own funds.

If VCs have so many benefits, then why are the Governments sceptical of considering them as legal tender? The VCs are based on blockchain technology, which is highly secure. A wallet is linked to a private key rather than an individual person. Therefore, the Governments find it challenging to trace the origin of a transaction. Because VCs use pseudonyms to carry out transactions, it has the potential of being used for illegal activities. Another concern is that since VCs are not backed by Government or any commodity and therefore can lose their values if the promoter of the VCs stops trading activity.

However, the most vocal advantages of VCs are that they can be “mined” by a computer that involves a process of solving arithmetical problems or algorithms, which are used to verify transaction blocks to be added to the blockchain. As stated earlier, VCs are secured by blockchain, which is an ever-growing list of transactions. One can use a computer to validate these transactions and, as a reward, receive a cryptocurrency. The size of bitcoins block rewards is halved after the creation of every 10,000 blocks, which takes around four years. At bitcoin’s inception in 2009, each block reward was worth 50 BTC. In May 2020, the block reward was halved a third time to 6.25 BTC. The 6.25 BTC is approximately $ 140,000 USD and 50 BTC is $ 1.1m.

Unlike a physical currency note, Cryptocurrencies address this problem using ‘blockchains’. All users in the system have access to the account balance of all other users (code-names may be used to protect privacy). When a set of payments happen, they are bunched together in a “block which is connected to the previous block using cryptography, and published on the system. A chain of such blocks of transactions is called a blockchain. As this ledger is available to all users and validated by them, it is a form of Distributed Ledger Technology (DLT).

Cryptocurrency emerged as a person-to-person electronic cash system that allows online payments to be sent directly from one party to another, without the need of a financial institution. They are also used as utility tokens which provide the holder access to a company’s goods and services.

Why RBI is apprehensive

The RBI has been apprehensive about cryptocurrencies because of their cryptic nature and absence of any intrinsic value and a slew of so-called crypto exchanges, many playing their business online, and soliciting customers through mass media advertising promising superlative returns. The crypto crash in some cases has served up a dose of reality to customers, at least some of whom do not really understand crypto currencies and saw them as instruments that could generate high returns.

In India, the Crypto trading platforms WazirX, CoinDCX, and Unocoin are experiencing a substantial jump in volumes. It is at the same time that the RBI has been cautioning users, holders and traders of Virtual Currencies (VCs) vide public notices that dealing in VCs is associated with potential economic, financial, operational, legal, customer protection and security related risks. The RBI on May 31, 2021 also advised its regulated entities, such as banks to continue to carry out customer due diligence processes for transactions in VCs, in line with regulations governing standards for Know Your Customer (KYC), Anti-Money Laundering (AML), Combating of Financing of Terrorism (CFT), and obligations under Prevention of Money Laundering Act (PMLA).

This was in addition to ensuring compliance with relevant provisions under Foreign Exchange Management Act (FEMA) for overseas remittances. The central bank also registered its concerns over the adverse effect of cryptocurrency on the economy. It has clarified that the value of fiat currencies is anchored by monetary policy and their status as legal tender, however the value of cryptocurrencies rests solely on the speculations and expectations of high returns that are not well anchored, so it will have a de-stabilising effect on the monetary and fiscal stability of a country.

The central bank has been working on modalities for central bank digital currency. However, it has expressed reservations on private cryptocurrencies. The RBI Governor Shaktikanta Das has already said that cryptocurrencies are a very serious concern from the macro-economic and financial stability perspective. However, more than 80 per cent of central banks are looking at digital currencies.

Global regulation

China’s digital RMB was the first digital currency to be issued by a major economy. On September 27, 2021, Tajikistan announced the creation of a CBDC with the Fantom Foundation, and Nigeria was the first African country to launch its CBDC on October 25. The Bank of America said in its recent report that a US CBDC would differ from the digital money currently available to the public because it would be a liability of the US Federal Reserve, not a commercial bank, and so would have no credit or liquidity risk. The US Fed has also published a discussion paper on the benefits and risks of a CBDC.

Countries like Canada regulate VCs under their money laundering laws, trading in VCs is permitted on an open exchange and the revenue generated is taxed under their income tax laws, VCs are also used to avail products and services. Further, Japan permits the use of VCs as payment systems.

What is the Crypto Bill

The text of the Bill is yet to be released to the public. But sources said ‘The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021’ seeks ‘to create a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India. The Bill also seeks to prohibit all private cryptocurrencies in India; however, it allows for certain exceptions to promote the underlying technology of cryptocurrency and its uses’.

The proposed Bill may ideally serve to introduce a level of uniformity of understanding and serve to bring the various government agencies involved onto the same page while also providing security and helping regulate the otherwise unregulated markets and prevent its misuse. On the surface, the Bill seems to be very restrictive in nature as it seeks to ban all private cryptocurrencies including mining and trading therein. The Bill further seeks to promote the ‘official digital currency’ that is to be issued by the Central Government and the RBI. Further, the penalties prescribed under the Bill seem to be disproportionately harsher when compared with similar economic offences.

It is learnt that the draft Bill seeks to prohibit mining, holding, selling, trade, issuance, disposal or use of cryptocurrency which is defined as any information, code, or token which has a digital representation of value and has utility in a business activity, or acts as a store of value, or a unit of account. The draft Bill bans all cryptocurrencies based on the risks associated with them such as potential use for money-laundering, risks to consumers and threat to the country’s financial stability.

The way forward

The question now is whether banning all private VCs and having a single regulated ‘official digital currency’ defeats the purpose of VCs in general or is justified given the volatility as well as the potential for misuse. If properly regulated, the Government can tax the revenue generated, which can be a win-win situation for both the Government as well as investors. While there are genuine concerns over the usage of VCs, regulation rather than prohibition could be a more viable option.