Despite the GST cuts rolled out by the government to ease consumer burden, most local retailers in Delhi-NCR continue selling essentials at old rates, denying relief and leaving ordinary buyers paying more than promised. A report by TehelkaSIT.

In his Independence Day speech on August 15, 2025, Prime Minister Narendra Modi announced the “Next-Generation” Goods and Services Tax (GST) reforms, that would include substantial rate cuts. He described the changes as “Diwali gifts” for citizens and a way to reduce the tax burden on the ordinary person. The new rates came into effect on September 22, 2025, coinciding with the start of Navratri festival. A day before the new GST rates were implemented, Prime Minister Modi addressed the nation, promising that the “Next-generation GST reforms” would simplify the tax structure and make hundreds of everyday goods and services more affordable. The earlier four-tier structure (5%, 12%, 18%, 28%) was replaced with a simpler two-tier system of 5% and 18%.

Immediately after the announcement of the GST rate cuts, the Central Consumer Protection Authority (CCPA) was tasked with ensuring that businesses passed on the full benefits of the reduced GST rates to buyers. Violators could be charged with “unfair trade practices,” an offence under the Consumer Protection Act, 2019. A special wing of the consumer-rights watchdog was directed to monitor market rates of over 430 commonly traded items through field inspections following the new, lower national consumption tax. “The CCPA will keep a tight vigil to ensure all benefits of the new GST regime are passed on to consumers. Any violation will be treated as an unfair trade practice and action will be taken,” said Nidhi Khare, Union Consumer Affairs Secretary, as reported by the media.

The GST Bachat Utsav—the GST savings festival—was launched with much fanfare following the rate reductions. But reports from across the country indicate that shopkeepers are not passing on the benefits of these cuts to customers. Traders continue to sell goods at old prices, claiming they are “clearing old stock” purchased under the previous tax rates. Under the GST 2.0 reforms, the central government had reduced tax rates on several categories of products, claiming this would ease the burden on ordinary citizens ahead of the festive season and help them save more. However, consumers allege that traders are misleading and overcharging them, taking advantage of lax monitoring.

To find out the ground reality, Tehelka carried out a reality check in Delhi-NCR to see whether shopkeepers were actually passing on the GST benefits to the common man. During this exercise, Tehelka visited several stores—big and small—and spoke to ordinary people for whom the government had promised relief through the GST rate cuts.

“GST rate cuts are mostly benefitting the rich, not the poor. Car prices have come down after the cuts, but cars are bought by the rich, not the common man. Big branded stores are passing on the GST benefits, but ordinary grocery shops are not offering any rate cuts. The poor generally buy daily needs items from local kirana shops, and not from branded stores,” said Sudhir Kumar, who runs a mobile shop in Wazidpur, Sector 134, Noida. He admitted that he himself was selling items at the same old rates.

“I’m selling medicines at the old rates because my stock is old. So, I’m not offering any GST relief to my customers. When new stock comes with new MRPs, we’ll see then,” said Parvinder Mavi, owner of Durga Medical Store in Nagli, Sector 134, Noida.

“I’m not getting any GST relief on the coconuts I buy from Azadpur Mandi in Delhi, so how can I sell coconut water at lower prices? Whenever I mention the GST cut to traders at the mandi, they ignore it and tell me either to buy at the old price or leave,” said Nadeem Khan, a coconut water seller in Sector 107, Noida.

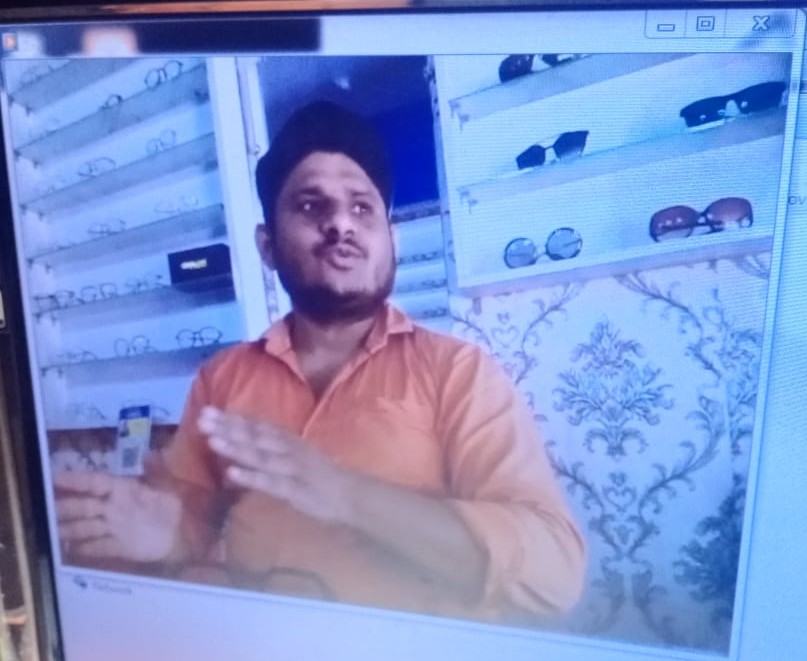

“All daily-need items are selling at the same old prices. Nothing has changed after the GST cuts—it’s all on paper. Whether you buy flour, milk or anything else, the prices are unchanged. There’s no GST relief for the common man. If I’m selling eyeglass frames at old rates, that’s understandable because they’re from old stock. But curiously, even daily essentials are being sold at the same prices,” said Mustakeem, owner of Malik Optical Shop in Wazidpur, Sector 134, Noida.

“I haven’t got any price relief after the GST cut. I’m paying the same rates for daily essentials as before,” said consumer Kirpal Maurya.

“My salesman told me that the items I buy for my shop are still priced the same. There’s been no reduction after the recent GST cut announced by the government. So, I’m charging the same rates for haircuts, shaving, hair colour and other services. The GST cut exists only on paper. Even household items like rice, flour and cooking oil are still being sold at old rates. There’s been no price relaxation at all,” said Naseem, a barber shop owner in Sector 134, Noida.

During its GST cut spot checks, Tehelka met Parvinder Mavi, owner of Durga Medical Store in Sector 134, Noida. In the following brief exchange with him, the reporter finds that the much-publicised GST rate cuts have failed to trickle down to consumers. Mavi admits that he continues to sell medicines at old rates, citing unsold stock as the reason. Though he acknowledges that prices may drop with new supplies, the benefit remains theoretical for now—leaving the common buyer untouched by the so-called relief.

Reporter- Ab to rate kam ho gaye honge dawai par, GST hatne se?

Parvinder- Abhi to chal raha hai.

Reporter- Chal raha matlab?

Parvinder- Abhi market jana nahi hua na, kuch par badhenge, kuch par ghatenge.

Reporter- To aapke wahi rate hain….purane wale?

Parvinder- Haan.

Reporter- Purana stock hoga, kisi par GST kam nahi hue?

Parvinder- Abhi mere pass to nahi, jo hai purana hi hai.

Reporter- Dawaiyon par to lagbhag sabhi par GST kam hui hai?

Parvinder- Haan ab jo maal aayega na.. uspar.

Reporter- Abhi purana maal hai?

Parvinder- Abhi purana maal hai.

Reporter- Usi rate par bech rahe ho,,,,puranae wale?

Parvinder- Haan, ab jo aayega na, MRP kam hokar aayega.

Reporter- Tabhi janta ko fayda nahi ho raha aapse.

[This interaction underlines how traders use “old stock” as a convenient shield to avoid passing on tax benefits. It shows the gap between government announcements and actual market behaviour. The lesson is clear—without vigilant enforcement, consumer gains stay on paper.]

Now, we met Nadeem, who has been selling coconut water in Sector 107, Noida, for many years. We asked him whether the price of a coconut had come down after the GST cut. He replied in the negative. Nadeem said that since the rate of coconuts at Azaadpur Mandi in Delhi—where he purchases the fruit—has not decreased, he cannot sell coconut water at lower prices. His rates have remained the same for the past several months: Rs 80 per coconut. In the ensuing exchange, it becomes evident that the impact of the GST cuts has not reached the ground.

Reporter- Kya rate hai Nariyal paani?

Nadeem- 80 rupay.

Reporter- Abhi kum nahin kiye rate tumney?

Nadeem- Kaafi time se hai.

Reporter- Arey par ab to GST kum ho gayi?

Nadeem- Aaj bhi 72-71 rupay hai nariyal Azaadpur Mandi mein.

Reporter- Nariyal paani par bhi to GST kum hui hai?

Nadeem- Mandi wale jab kum de tabhi to ho.

Reporter- Mein to samajh raha tha ki tum 60 rupay ka bechogey aaj?

Nadeem- Aaj bhi 70-72 rupay Azaadpur mandi mein hai.

Reporter- Nariyal ki keemat?

Nadeem – Ha.

Reporter- Kaha se laatey ho?

Nadeem- Azaadpur se.

Reporter- Waha bhi kum nahin hua?

Nadeem- Waha bhi kum nahin hua.

Reporter- Humein kaisey pata…ho sakta hai jhooth bol rahe ho tum?

Nadeem- Humara daily ka kaam hai.

Reporter- Wahan GST kum ho gayi ho par tum GST laga rahe ho?

Nadeem- Apki baat main manta hun.. magar mandi key andar koi nahin manta. Waha to paisa mangta hai, kehte hai ye rate hai….lena ho to lo nahin to jao.

Reporter- Tum to 80 rupay bahut time se bech rahe ho?

Nadeem- Bahut time se.

Reporter- Nahin.. GST kum hui hai.. tab to sasta hona chahiye?

Nadeem- GST kum hui hai to maal sasta hona chahiye…magar mandi ke andar sasta nahin hua.

[This interaction exposes a clear disconnect between policy and practice. The trader accepts that GST has been reduced but passes the blame up the supply chain. It reminds us that without accountability at every level, benefits rarely reach the end consumer.]

When Tehelka contacted Malik Optical to check whether the consumers were getting the benefit of GST relief while buying items from the shop, its owner, Mustakeem, told the reporter that prices of daily-need items have not changed after the GST rate cut. He said he is paying the same prices for all essentials as he was before the tax relaxation. According to him, the GST rate cut exists only on paper. Even the prices of the merchandise he was selling, such as spectacle frames, continue as before—unaffected by the so-called reforms, he said.

Reporter- Ab to rate kam ho gaye hongey frame ke… GST hat gayi hai..?

Mustakeem- Kis cheez ke rate kam hue hain bata do!? Doodh aaj bhi 70 rupee kilo hi aa raha hai, anaj bhi wahi rate aa raha hai…ye dikhane ke liye hi hai kaagazon mein, haqeekat mein kuch bhi nahi hai.

Mustakeem (continues)- Doodh 70 hi aa raha hai abhi kyun, ek rupiya bhi kam na hua. Ye to chodho (referring to frames), roz nahi kahreede ga aadmi, jo roz ki cheez hai daily ki, usmein 1 rupiya bhi kam nahi hua hai, kaagazon mein hai bas.

Reporter- Sarkar keh rahi hai GST hata di 22 September se.

Mustakeem- Chalo frame to aisi cheez hai 6 mahine pehle kharida, 4 mahine pehle kharidi, lekin jo roz packing mein aa rahai hai usmein 1 paisa kam na hua abhi tak. Doodh ka rate wahi hai 70, jo pehle tha.

Mustakeem (continues) – Jo packet mein aate hain doodh..uski baat kar raha hoon.

Reporter- Motherdairy ka bhi wahi rate hai?

Mustakeem- Wahi rate hai, ek paisa bhi kam nahi hua.

Reporter- Hamari society mein jo Motherdairy hai usne to kam kar diya.

Mustakeem- Kisi ne bhi kam nahi kiya sir, MRP check kar lo, usi rate par mil raha hai, ek cheez par bhi kam nahi hua hai, kaagazon mein hai!

Reoporter- Matlab abhi chashmon mein bhi nahi hai, abhi koi umeed nahi hai.?

Mustakeem –Nahi sir, abhi kaagazon mein hi hai…yahi haqeeqat hai.

Reporter- Kaagaz matlab aapke ya sarkar ke?

Mustakeem- Sabke… hamare pass to hokar hi jayega jab order aayega to.

[In the above exchange with the owner of an eyeglasses shop in Noida, frustration over the hollow nature of the GST relief is unmistakable. Mustakeem says that even prices of essential items like milk and grains have remained unchanged despite government claims. He points out that the rate cuts exist only on paper, with no visible effect on daily purchases.]

Tehelka then contacted Naseem, owner of a barber shop in Sector 134, Noida, to check whether he had reduced his rates after the GST cuts on several items used in his shop. According to Naseem, his supplier told him that the products he purchases for the shop are still priced the same, with no reduction after the GST relaxation. Therefore, he continues to charge the same rates for haircuts, shaving, hair colouring, and other services. To buttress his argument, Naseem said the GST cut exists only on paper—he is still buying daily household items like rice, flour, and cooking oil at old rates, with no price relief whatsoever. Instead, he plans to increase the rates after Diwali, as his landlord is set to raise the shop rent.

Reporter- Ab to cutting ke rate kam kar diye honge tumne?

Naseem- Diwali se badh jayenge aur!

Reporter- Arey! GST kam ho gayi, saamaan sasta ho gaya, phir bhi?.

Naseem- Hamari kam nahi hui.

Reporter- Aapki kam nahi hui? Kya chal raha hai cutting ka rate?

Naseem- Wahi… 70 rupay.

Reporter- Wahi jo pehle tha? Aur shaving?

Naseem- 60 rupees straight banana ka.

Reporter- Cutting 70 rupees jo pehle thi?

Naseem- Haan Diwali se rate badh jayega.

Reporter-Kyun?

Naseem- Diwali ke baad kiraya badh jayega.

Reporter- Accha, tumhari dukan ka kiraya badh jayega?

Reporter- Ab to rate kam kar diye honge?

Naseem- Hamare samaan par kam nahi hua.

Reporter- Kuch kam nahi hua? Tum usi rate par le rahe ho?

Naseem- Wo kehta kahin kam nahi hua hai… lao dikhao hame.. kahin kam nahi hua hai.

Reporter- Wahi rate chal rahe hain?

Naseem- Ration ke kam hue hain… ab ration wale ne bhi band kar diye hain.. keh raha hai hamare bhi kam nahi hue, dikhao kaha hai?

Reporter- Tum to keh rahe ho kam hue hain ration ke?

Naseem- Akhbar mein likha hai magar ye log maantey nahi hain, uspar hua hai.. shampoo par.

Reporter- Aap ration le rahe ho purane rate mein?

Naseem- Purane rate mein.

Reporter- Aata waata sab koi kam nahi hua, GST nahi hati?

Naseem- Nahi…hum tel letey hain..ek rupiya bhi kam nahi karta hai.

Reporter- Ek baar jo badha deta hai, kam nahi karta hai.

[In this exchange with a barber in Noida, the disconnect between policy announcements and everyday reality becomes strikingly clear. Naseem admits that despite the government’s claims of GST cuts, he continues to pay the same old rates for all his supplies. His service charges too remain unchanged, and he even plans to raise them after Diwali due to increased shop rent. It reinforces how disconnected policy intent can be from market realities.]

We then visited Moviemax, a multiplex in Gulshan One 29 Mall, Noida, to check the rates of popcorn being sold to cinegoers at the theatre where the movie Jolly LLB 3 was being screened. The salesman told us that the prices at Moviemax have not changed after the GST cuts. According to him, rates in none of the multiplexes have been reduced yet; and any potential change depends on a mail from management. If they receive a rate-cut notification, the prices will be lowered.

Reporter- Popcorn kya rate hai ?

Salesman- 550 aur 650.

Reporter- O.K. With butter or without butter?

Salesman- Without butter.

Reporter- O.K. Kuch kum nahin hue rate GST ke baad?

Salesman- Nahin, abhi itna hi hai.

Reporter- Moviemax mein rate hi kum nahin hue GST ke baad?

Salesman- Nahin, kahin bhi abhi kam nahin hue. XXXX main bhi nahin hue.

Reporter- XXXX main bhi kum nahin hue .

Salesman- Ho jayengey, mail ayega to uske baad ho sakte hai.

Reporter- 22 September ko hi GST kum ho gayi thi.

Salesman- Mail to oopar se aata hai.

Reporter- Water bottle kitne ki hai aapki?

Salesman- Rs 70 ki, sir.

Reporter- Uspar bhi kum nahin hue?

Salesman- Hoga to sir bilkul ayega.

[At a multiplex counter, the reporter’s inquiry into the impact of GST cuts on food prices reveals another layer of inaction. The salesman admits that rates for popcorn and bottled water remain unchanged despite the tax reduction. He explains that no price revision can happen until official communication—or a “mail from above”—arrives. The exchange typifies how bureaucratic delay becomes an easy excuse for keeping consumers out of the benefit loop.]

As paneer prices have also come down, we visited Evergreen Sweet Shop in Sector 134, Noida, to see whether the rates of paneer samosas had decreased after the GST cut. To our surprise, the salesman at the counter said that the samosa prices had not come down despite the reduction in paneer rates. He explained that the gas cylinders used for frying the samosas are still priced the same, and the labour involved in frying them has not taken any pay cut. Therefore, he charged ₹17 for one samosa, the same rate as before the GST cut. When we spoke to the labourer frying the samosas about the prices, he said that once rates are raised, nobody lowers them—but when costs go up, prices increase immediately depending on the situation.

Reporter-Ye Paneer ka samosa hai na?

Salesman- Haan.

Reporter- Mil jayega?

Salesman- Haan.

Reporter- Kitney ka ek?

Salesman -17 rupay ka.

Reporter- 17 rupay? Sasta nahi hua abhi , GST hatney ke baad, paneer se GST hat gayi na. Hum samajh rahe they ki sasta ho gaya hoga?

Salesman- Paneer se hi to hati hai, karigaron se to nahin. Karigar to utney ka hi hai. Gas cylinder utney ka hi hai. Kewal paneer se kya hoga?

Reporter- Samosa abhi bhi mehnga hai.. 17 rupay ka ek. Main soch raha tha GST hat gayi hai paneer se, to samosa sasta ho gaya hoga?

2nd Salesman-Rate ghat jaye to kum nahin karte. Bada dengey.

[This exchange highlights how minor tax cuts often fail to reach end consumers. Traders hide behind ‘other expenses’ to maintain prices, showing that policy benefits can vanish in the complex cost structure. It reminds us that real relief depends on practical implementation, not just announcements.]

In Noida’s Sector 134, we met Sudhir Kumar, a mobile shop owner. When asked about the GST rate cuts, Sudhir said they mostly benefit the rich, not the poor. Car prices have come down after the GST cuts, but cars are bought by the wealthy, not the common man. Big branded stores are passing on GST reductions to customers, but ordinary grocery shops are not offering any discounts. “The poor buy daily-need items from local grocery stores, not branded outlets,” said Sudhir Kumar.

Kirpal Maurya, a driver, told us that he has seen no relief in prices after the GST cut on daily-need items from his local grocery stores. He said he continues to pay the same prices as before.

We also visited a medical store near the gate of Shanti Mangalick, a multi-speciality hospital on Fatehabad Road, Agra, Uttar Pradesh. When asked whether medicine rates had come down after the GST cut, the salesman at the counter promptly replied that the prices remain unchanged despite the GST relaxation.

However, not all stores visited by Tehelka were withholding the GST benefits from customers. Moonis, a salesman at Apollo Pharmacy, said they are offering GST cuts on medicines. He admitted that many local medical stores are not passing on the benefits to customers, citing old stock as the reason.

As the brief exchange with a medical store owner unfolds below, it becomes clear that the GST cuts are benefiting only a few, while most of the local shops are unable to pass on the relief. Moonis explains that most stores are still clearing old stock, preventing any reduction in prices. He acknowledges that while his store is giving the benefit, the majority of traders continue to charge customers as before, highlighting the uneven implementation of the policy.

Reporter- Aap to GST ka fayda de bhi rahe ho; bahut se nahi de rahe.

Moonis- Roz system update hota hai, bahut se log to de nahi rahe hain, abhi purana stock pada hua hai.

Reporter- Bahut saare medical store nahi de rahe.

Moonis- Nahi, local wale to de nahi pa rahe, kehte hain purana stock hai.

Reporter- To aap kaise de rahe ho?

Moonis- Haha..

[This interaction shows that GST benefits are reaching only select consumers. Old stock and system delays keep most shops from reducing prices, leaving ordinary buyers short-changed. It underscores that policy intentions need active enforcement to truly make a difference.]

Modern Bazaar, a large retail chain outlet in Gulshan One 29 Mall, Noida, we were told by their sales staff that GST cuts are fully applicable at their stores on all grocery items. However, their salesman, Satya, admitted that local grocery stores are not passing on GST benefits to common people, and he considers himself one of the affected customers.

Reporter- Groceries par rate kam hue kya?

Salesgirl- Haan sir hue to hain.

Reporter- Kis-kis par hue hain?

Salesgirl- Ye nahi pata , daal par… sari groceries par, infact kitna kam hua hai ye to aapko sir bata saktey hain.

Reporter- Daal chawal.. sab par kam hua hai?

Salesgirl- Ji.

Reporter- Haan groceries par rate kam hue hain GST ke baad?

Satya- Aap rate dekh lijiye bill par aapko rate de deta hoon.

Reporter- Jaise aata hai, daal hai, chawal?

Satya- Sab par hua hai…ye dekh rahe ho aap…GST rate hai…aaiye abhi to offer chal raha hai.

Reporter- Wo purane rate par hi bech rahe hain.

Reporter- Aapne to kam kar diye hain par jo normal grocery stores hain wo nahi kar rahe, Modern Bazaar ne to kam kar diye.

Satya- Haan, mein bhi gaya tha, mujhe bhi wahi rate diye hain…abhi purana stock nikal raha hai, maine bola bill bhi to dikhna chahiye.

[This interaction shows that even where GST benefits are officially applied, consumers may not immediately see reduced prices. Old stock and billing practices slow the impact, reminding us that policy effectiveness depends on consistent implementation and transparency. The exchange highlights how organised stores may implement cuts selectively, leaving customers deprived of the promised benefits.]

In Tehelka’s reality check, all branded stores dealing with groceries and medicines were found passing on GST benefits to their customers. But small medical and grocery stores are not offering these benefits to their poor customers, claiming they are clearing old stock purchased under previous tax rates.

In many shops visited by us in Delhi-NCR, there are no notice boards, and traders are openly flouting the rules, failing to reflect promised price reductions for most items. Consumers allege that traders are fooling and fleecing them by selling products at old rates due to this lack of monitoring. The non-implementation of the new rates appears particularly severe in the case of medicines and essential commodities.

Shopkeepers and medical stores continue to charge old rates without fear of action from the authorities. We, at Tehelka, are of the opinion that the government should immediately launch special drives, inspect markets, penalise violators, and start a public helpline to ensure the benefits of GST rate changes reach the common people. Even a small delay in enforcement causes a massive financial loss to consumers. Prompt action and creating public awareness about the issue are critical. The government has announced strict measures against shopkeepers and businesses that fail to pass on GST benefits to customers, but enforcement on the ground must match intent.