Last budget of the NDA government, also called an interim budget, led by Prime Minister Narendra Modi has been presented by an interim finance minister, as many observers call it,

Last budget of the NDA government, also called an interim budget, led by Prime Minister Narendra Modi has been presented by an interim finance minister, as many observers call it,

Piyush Goyal in Lok Sabha on 1 February. It is interesting to note that a day before, Piyush Goel had told an all-party meeting that a “Budget is a Budget” and there is nothing like an interim budget or a vote-on-account.

However, Prime Minister Modi was quick enough to make it clear to the Opposition that his government would present an “interim Budget” in the Lok Sabha Friday. He gave this assurance to leaders of parties at a session-eve meeting at the Parliament. The Union Home Minister Ranjnath Singh had also reiterated what Modi stated. after the Opposition Congress’s vow to oppose any attempt at presenting a full-fledged Budget when the government’s tenure was scheduled to end in May, is said to have forced the Modi government on to the backfoot.

The interim budget is said to have evoked a mixed reaction from various segments of the Indian society. The middle class has welcomed the tax sops and some farmers’ organizations have expressed mixed reactions on the sops offered to the farmers, especially an offer of 6,000 every year to small holding farmers.

Commenting on the budget, former finance minister P Chidambaram said it was not a Vote on Account but an Account for Votes. A critic, separately, termed the budget as “Santa Claus budget” offering goodies without seeking an endurable and sustainable solution to agrarian distress. Various experts have raised doubtsover the pragmatic aspects of these ops for a selected target of audience in the election year leaving a Pandora’s Box of problems for the incoming government.

Sops in election year

This interim budget offers sops for the middle class, small farmers and unorganised sector. It exempts persons with gross income of 6.5 lakh annually from paying any tax after considering investments of 1.5 lakh in tax saving schemes. It has also increased gratuity limit from 10 lakh to 30 lakh.

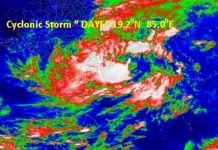

While doling out sops for small farmers, this budget envisages that farmers affected by severe natural calamity will get 2 per cent interest subvention on all rescheduled crop loans and additional 3 per cent on timely repayment. While harping on its move of fixing MSP for 22 notified crops at 50 per cent higher than cost of production, which has been widely contested by the farming community throughout the country, the budget promises structured income support for poor, landless farmers to meet input cost and farmers are to be provided

6,000 per year in three instalments, to be fully funded by the central government Besides, it also offers 2 pc interest subvention to farmers involved in animal husbandry and fishery. Last but not the least, it also refers to government’s promise of providing 750 crore in FY to support animal husbandry and fishing.

While making sops, it sang in praise of demonetization and avoided the adverse impact of this move on job loss and economic destabilization od the MSME sector. The very fact that tis budget offers sops for the unorganized sector deems indirect admission by the government that this sector was made to suffer severe strains as a result of demonetization. Increase in taxation base is cited as the positive outcome of demonetization, a claim that is contested by many experts.

On the ticklish question of generating jobs over the last five years, the Budgets repeats the stereotype version of the government by citing rise in EPFO membership, mudra yojana etc., which are highly debatable. Claiming that during the last 5 years under all categories of workers, minimum wages increased by 42 per cent,which is the highest ever, the budget envisages government’s plan to launch mega pension yojana for 42 cr unorganised sector workers; assured monthly pension of 3,000 after reaching the age of 60.

Utopian outlook

Interestingly, the budget reportedly offers a utopian outlook for the coming decade coinciding with the year 2030, a year earmarked by the United Nations to realize the 2030 Agenda of sustainable development by implementing 17 Sustainable development Goals along with their 69 targets with a view to ensure that no none is left behind. However, the budget is silent on India’s achievements on SGs. One of the utopian outlooks focuses on India being on the way of becoming global manufacturing hub, including automobiles, electronics and defence. It also envisages building physical and social infrastructure for $10 trillion economy, says FM.

The budget claims that the Modi-led NDA government has laid foundation for India’s growth and development for times to come and that India will be modern, technology-driven, equitable and transparent society by 2030. Many critics maintain that such utopian formulations can be construed in terms of BJP’s roadmap for coming decade to remain in power by hoodwinking the masses on rhetoric that to focus on walk the talk.

Way forward

What worries many critics that wherefrom the government raise its revenue to implement such glossy announcements, especially when the NDA government is already building pressure on theRBI to pay part of its profits to the government before a crucial election due by May, providing Modi government with cash to boost spending and voter support, while keeping the budget deficit in check. In reality, this government is setting a dangerous trend by interfering with the autonomous functioning of the central bank. Besides, in its frenetic efforts to neutralize Congress president’s recent announcement of ensuring minimum income guarantee to the poor segments of the population, Modi government’s interim budget seems to be an exercise in hoodwinking the farmers and the middle class by offering these sops which may not get fructified immediately and may prove another jumla.

Without addressing the job crisis and agrarian crisis in an effective manner, the interim budget has left the people, with the exception od salaried class benefitting from tax sops, high and dry. In the wake of Modi government’s quota reservations for the economically weaker sections with the income bracket of 8 lakh rupees, the middle class has been expecting the taxexemption up to 8 lakh and instead they got exemption up to 5 lakhs. Another important aspect is that it has left a Pandora’s Box od controversies and problems for the ensuing dispensation that be at the helm in the aftermath of May 2019 elections. Such sops at the last moment reminds of a rural saying that what is the use of rain when the farm produce has already been destroyed due to drought.

The author is Executive Editor of News24. Views expressed are his own

letters@tehelka.com